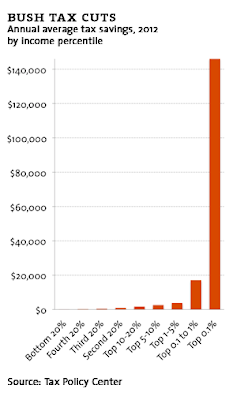

Consider this chart showing the terrible tax burden the very wealthy carry, courtesy of Dave Gilson at Mother Jones:

Look at how much the rich are paying in... Oh wait, that says "savings." Never mind.

In fact, to dial in a little bit, here's a comparison of what the average resident of the Park Avenue Helmsley Building -- who earns $1.2 million a year on average -- pays and what a janitor in that building might pay:

So, the guy living at a posh Park Avenue address pays a lower percentage of his income than the guy vacuuming the halls.

Now, the most common argument here is that the millionaire is a "job creator." But the fact of the matter is that it's consumers, not employers, who create jobs. Where the janitor likely spends most of the money he earns -- creating demand and with it jobs -- the millionaire doesn't. You could argue that what money the millionaire spends is probably more than the janitor spends and you'd probably be right. But there are a lot more people in the janitor's tax bracket than in the millionaire's -- taken as a whole, the janitors are going to create a lot more jobs than the millionaires ever will. So giving the biggest tax break to the rich guy makes no sense. There's a logical reason for progressive taxation and the current tax code sets that logic on its ear. Not only is this as unfair as you likely believe it to be, but it's also counterproductive.

And corporate taxes? Let's take a look at one last chart:

Yes, the US has a corporate tax rate of 35% -- on paper. The fact is that there are so many loopholes, dodges, and credits that no one actual pays that rate. If you want to discuss reality, then the effective corporate tax rate in the US is somewhere around seven or eight percent -- stupidly low. The next time someone complains about the high corporate tax rate, go ahead and point out that they're a moron. In the real world, corporations are barely taxed at all in this country.

Which is again counterproductive. Corporations are consumers, but they're reactive ones; their consumption is driven by your consumption. If everyone's spending more money, corporations spend more money to meet your demand. If everyone's spending less, the opposite is true. Again, we're putting the greatest tax burden on the people who actually create jobs and giving the lightest burden to those who only react to demand. This makes no damned sense at all.

Not only are we increasing deficits with this insane, bass-ackward tax code, but we're holding the economy back. The time to kick supply-side economics to the curb has long since passed.

-Wisco